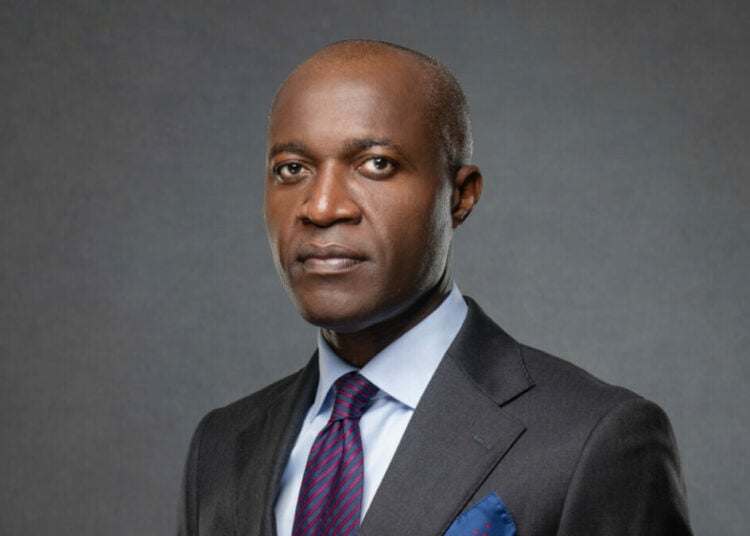

The purchase of a £15 million mansion by the Chief Executive Officer (CEO) of Access Bank Plc, Roosevelt Ogbonna, in London’s upscale Hampstead area, known as Billionaires’ Row, has sparked strong reactions from civil society organisations and shareholders alike.

The property, reportedly acquired in August, features luxury amenities including a spa and entertainment suite, and was listed for £15 million by 2021.

Bloomberg reported that Ogbonna, who has been the boss of Nigeria’s largest bank by assets for over three years, purchased the sprawling mansion in August, according to a UK filing.

Transparency International Nigeria and other civil society groups have expressed serious concerns, suggesting that such high-value acquisitions by bank executives may be linked to money laundering by public officials using bankers and legal professionals as fronts.

The head of Transparency International Nigeria, Auwal Musa Rafsanjani, said, “The issue is that he should declare his assets and taxes to the government and explain how he got the money. We have tried to encourage the UK to extend this new law on unexplained wealth. If he is a public officer, he must indicate how he got the money. Politicians now understand that under UK law, they cannot loot money, buy houses, and avoid declaring how the money was made. So, they are using lawyers and bankers to do this.

“Unfortunately, some lawyers and bankers are now serving as gateways for looted funds, helping public officers hide money in properties under the guise of private ownership.

“There is a need for the Federal Inland Revenue to investigate why he has not declared taxes amounting to the kind of money he has sent abroad.

“He must explain how he made that money. The unexplained wealth law should not apply only to public officials. It should also apply to those holding or transferring public officials’ money under false pretence, claiming it as their own when it is not.

“CISLAC strongly calls on the FIRS authorities to expand their oversight on some of these so-called financial institutions. In any case, financial institutions consistently refuse to declare their assets. We cannot fight corruption if we fail to address corruption within the financial system itself.”